Bond yields softened on Wednesday as the Reserve Bank of India (RBI) delivered a rate hike in line with market expectations, desisted from raising the cash reserve ratio (CRR) and made all the right noises about the conduct of the government’s borrowing programme. The yield on the benchmark 10-year government security dropped intraday to 7.431% and ended at 7.494%, two bps lower than its previous close. However, the day’s trade was marked by volatility.

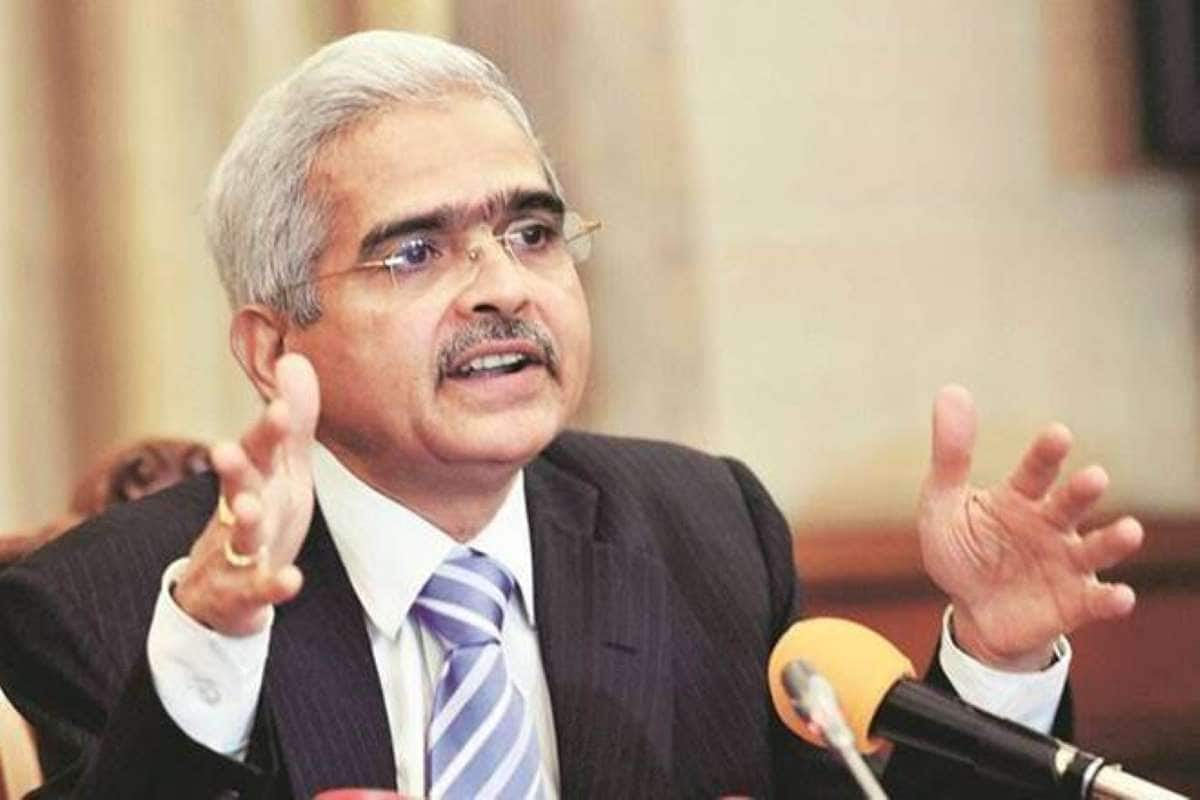

RBI governor Shaktikanta Das said the central bank will use all the instruments at its disposal to ensure an orderly completion of government borrowing. “One thing I can say is that with respect to Operation Twist, we have today greater leverage and flexibility because we have enough securities,” Das said, adding that absorption of securities through the standing deposit facility (SDF) has aided in accumulation of securities.

As the RBI moves towards “normal” monetary conditions, it would look to reach a state where the overnight call money rate is closer to the repo rate, rather than around the SDF rate, where it now stands. Surplus liquidity, as reflected in average daily absorption under the liquidity adjustment facility (LAF), fell to Rs 5.5 trillion during May 4-May 31, from Rs 7.4 trillion during April 8-May 3. “Nevertheless, the overhang of excess liquidity has resulted in overnight money market rates, on an average, trading below the policy repo rate,” Das said.

Mahendra Jajoo, CIO (fixed income), Mirae Asset Investment Managers, said bond yields remained stable at 7.5% levels at the long end as the market had largely priced in a rate hike of 50 bps. “The market has drawn comfort from the governor’s statement on conducting govt borrowing programme in an orderly fashion. The long end of the yield curve is finding support at 7.5% levels. However, in the absence of any further liquidity measures by RBI, long-term yields may harden further,” Jajoo said.

Had the governor not mentioned the orderly conduct of government borrowing, yields would have spiked further, said Aditi Nayar, chief economist, ICRA. “Yields will take a cue from the measures that the RBI announces as well as their magnitude. Perhaps the central bank will carry out Operation Twist to manage the yield curve,” she said.

Despite the central bank’s assurances, market participants believe the respite to bond markets will be short-lived and volatility will soon take over. Akhil Mittal, senior fund manager, Tata Mutual Fund, said although the RBI has managed to calm nerves for now, the absence of a clear road map for support measures with persistent huge supply will continue to exert upward pressure on the longer end of the yield curve. “At the shorter end, yields are expected to remain range bound with the market keeping a close eye on liquidity,” he said.

Icra’s Nayar said the RBI may allow short-term rates to rise and manage expectations on the 10-year. At the same time, measures it takes will have to have a meaningful magnitude to cap long-term yields as all other factors are pointing at yields hardening further, such as global tightening and rising crude oil prices.

More front-loaded rate hikes are also expected. Sujan Hajra, chief economist and executive director, Anand Rathi Shares & Stock Brokers, said at the peak of the hiking cycle, the RBI could take the repo rate to the 6-6.5% range. “While the major part of rate hikes by the RBI are already factored in by most parts of the financial market, in the near term, the higher-than-expected rate hike can have some negative influence on the equity and bond markets,” he said.

Leave a Reply